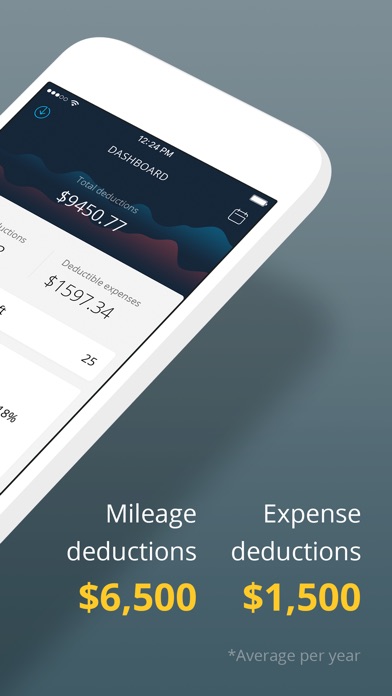

Mylage provides the simplest way to accurately track your business mileage and expenses. Just one mile of driving for business equals you 54.5 cents, 10,000 miles will make $5,450. An average tax reimbursement using Mylage equals $6,500.

> Capture every mile

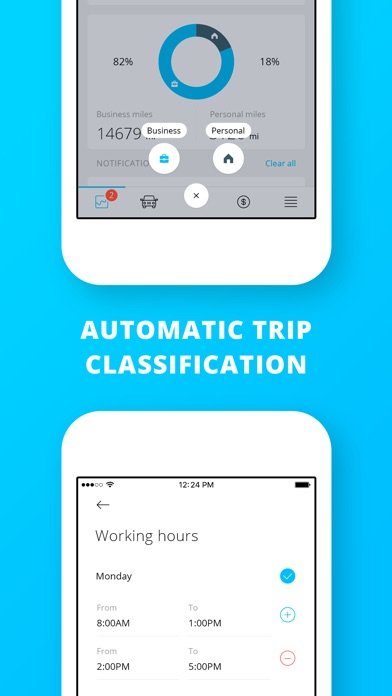

> Automatic classification

> Maximum deduction

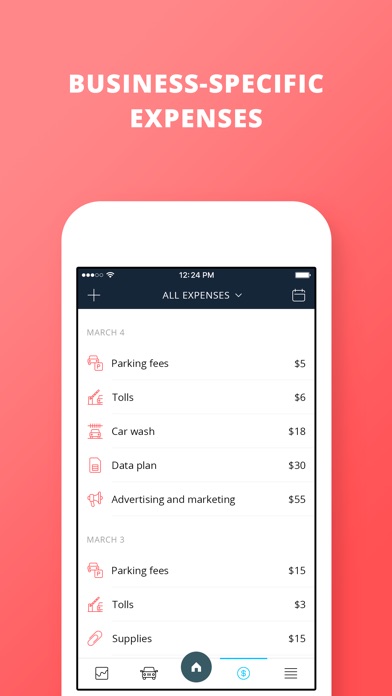

Mylage is a convenient solution for all self-employed people, whether you are a rideshare driver, tutor, sales agent or real estate agent. Select your occupation first, and you’ll see all deductible expenses typical for your business.

MILEAGE TRACKING

- Accurate mileage log

- Tracking offline and in the background

- Easy classification – no swiping

- Choose your status for automatic classification

- Set your work schedule

- All tech means of your phone are used to capture every mile.

BUSINESS EXPENSES

- Business-specific expenses

- Easy way to add and repeat expenses

- Customize categories and add necessary items

- Automatic calculation of gas cost.

STATS AND TIPS

- Compare Actual Expenses and Standard Mileage rate deductions

- Review your expenses and deductions in the real time

- Download detailed IRS-ready reports for any period of time

- Useful tips and notifications in the app.

How is Mylage different from other tracking apps?

• Simpler: Mylage tracks and classifies your miles automatically. No more swiping – just choose your status or set time when you’re working.

• More flexible: If you’re self-employed – it’s for you. Mylage lists occupation-specific expenses and provides an easy customization to suit your needs.

• More accurate: All technical means of your phone are used to ensure precise capturing of every trip.

• Clearer: Keep an eye on your tax deductions using Standard Mileage and Actual Expenses methods and compare them in the real time.

Didn’t find your occupation or necessary expenses on the list? Email us at [email protected] and we’ll add them in the upcoming update.

Stay in touch:

Website: https://mylage.io

Support: [email protected]

Facebook: https://www.facebook.com/MylageApp

Twitter: https://twitter.com/MylageApp

Note: Continued use of GPS running in the background can dramatically decrease battery life.

Pricing info: Mylage is free to download and track 100 trips. After this period, you can choose one of the trips packages, monthly or annual auto-renewable subscription. Payment will be charged to your iTunes Account at confirmation of purchase. Subscription will automatically renew unless auto-renew is turned off at least 24-hours before the end of the current period. Account will be charged for renewal within 24-hours prior to the end of the current period. You can manage your subscription and turn off auto-renewal in your Account Settings after purchase. The cost of subscription to Mylage is 100% tax-deductible as a business-related expense.

Privacy Policy: https://mylage.io/privacy.html

Terms of Use: https://mylage.io/terms.html